These are the lesson notes from the Elders Quorum lesson I taught today.

LOVING GOD MORE THAN MAN

Matthew 6:19-24:

19 ¶Lay not up for yourselves atreasures upon earth, where moth and rust doth corrupt, and where thieves bbreak through and steal:

20 But lay up for yourselves atreasures in heaven, where neither moth nor rust doth corrupt, and where thieves do not break through nor bsteal:

21 For where your treasure is, there will your heart be also.

22 The light of the body is the eye: if therefore thine aeye be bsingle, thy whole body shall be full of clight.

23 But if thine eye be evil, thy whole body shall be full of darkness. If therefore the light that is in thee be darkness, how great is that adarkness!

24 ¶aNo man can bserve two cmasters: for either he will dhate the one, and love the other; or else he will hold to the one, and despise the other. Ye cannot serve God andemammon.

Page 249, first middle of paragraph:

“All, however, that is necessary for us to do now is to see where our faults and weaknesses lie, if we have any. If we have been unfaithful in the past, let us renew our covenants with God and determine, by fasting and prayer, that we will get forgiveness of our sins, that the Spirit of the Almighty may rest upon us, that peradventure we may escape those powerful temptations that are approaching. The cloud is gathering in blackness. You see what were the results in Kirtland of this spirit of speculation. Therefore, take warning” (Lorenzo Snow, Deseret Semi-Weekly News, June 4, 1889, 4)

“Perhaps a few words in regard to our condition at that time [in Kirtland] might prove of some service to us in the future—might give us some useful lessons” (ibid).

Page 250, under the subtitle, “When people allow worldliness….” middle of first paragraph:

“…I was in Kirtland at that time, where we passed through scenes which, I sometimes think, we are now beginning to repeat. The circumstances which surrounded the Latter-day Saints at that time were of a peculiar nature; at least, the effects upon the people were of a peculiar character. … At that time a spirit of speculation pervaded the minds of the people of this nation. There were money speculations, bank speculations, speculations in lands, speculations in city lots, speculations in numerous other directions. That spirit of speculation rose out of the world, and swept over the hearts of the Saints like a mighty wave or rushing torrent, and many fell, and apostatized” (ibid).

The principle that President Snow was and is teaching here (at the time he was the President of the Quorum of the Twelve Apostles) is true, however the history he is providing and the manuel is providing, isn’t complete.

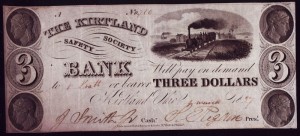

Part of the Problem that led to the large apostasy that occurred Kirtland was due to the failure of the Church-owned bank, The Kirtland Safety Society. President Lorenzo Snow give us the sense that it was all the lay-members’ fault, when in actuality it was not.

History:

The Kirtland Safety Society was an unwise venture that was probably illegal, though legal counsel was divided on that matter at the time. The intent of Church leaders does not seem to have been to break the law, but to solve a vexing problem which thousands of others also faced. The failure of the bank was not due to mismanagement or a desire to enrich individuals, but due to the relatively fragile nature of the time’s financial infrastructure, and the economic conditions of 1837. The lack of a charter was the Kirltand Safety Society’s biggest weakness and the most ill-advised decision connected with it. Arguably, even had the bank possessed a charter, the outcome would have been little different, save that the Church leaders would have suffered fewer legal problems and harassment.

The Kirtland Safety Society is an excellent example of why Latter-day Saints do not put their trust in men, but in God. It also demonstrates that the Saints will continue to support fallible men as prophets of God.

(source: fairmormon.org)

Brigham Young described an incident from his own life that speaks to the KSS period:

“I can tell the people that once in my life I felt a want of confidence in brother Joseph Smith, soon after I became acquainted with him. It was not concerning religious matters-it was not about his revelations-but it was in relation to his financiering-to his managing the temporal affairs which he undertook. A feeling came over me that Joseph was not right in his financial management, though I presume the feeling did not last sixty seconds, and perhaps not thirty…

Though I admitted in my feelings and knew all the time that Joseph was a human being and subject to err, still it was none of my business to look after his faults. I repented of my unbelief, and that too, very suddenly; I repented about as quickly as I committed the error. It was not for me to question whether Joseph was dictated by the Lord at all times and under all circumstances or not…“Had I not thoroughly understood this and believed it, I much doubt whether I should ever have embraced what is called “Mormonism.” He was called of God; God dictated him, and if He had a mind to leave him to himself and let him commit an error, that was no business of mine. And it was not for me to question it, if the Lord was disposed to let Joseph lead the people astray, for He had called him and instructed him to gather Israel and restore the Priesthood and kingdom to them.

“That was my faith, and it is my faith still… it is taught to the people now continually, to have implicit confidence in our leaders to be sure that we live so that Christ is within us a living fountain, that we may have the Holy Ghost within us to actuate, dictate, and direct us every hour and moment of our lives. How are we going to obtain implicit confidence in all the words and doings of Joseph? By one principle alone, that is, to live so that the voice of the Spirit will testify to us all the time that he is the servant of the Most High…” (Brigham Young, “He That Loveth Not His Brother…,” (29 March 1857) Journal of Discourses4:297-297.)

Thus, Brigham did not deny the error, or insist that it could not happen. But, he did not allow himself to be distracted by it.

“Why did Smith operate in such an unsound financial manner? Obviously, the church membership needed assistance and his well-known generosity prompted him in that direction. But, in addition, Brigham Young offered a complementary explanation in the 1850s when he refused to allow the Latter-day Saint organization in Utah to develop an official store. He told a congregation in Salt Lake City on October 9, 1852:

“Why does not our Church keep a store here?” Many can answer that question who have lived…in Nauvoo…Let me give you a few reasons…why Joseph goes to New York and buys 20,000 dollars worth of goods, comes into [Nauvoo] and commences to trade. In comes one of the brethren, “Brother Joseph, Let me have a frock pattern for my wife.” What if Joseph says, “No, I cannot without money.” The consequence would be, “He is no Prophet,”…After a while, in comes Bill and sister Susan. Says Bill, “Brother Joseph, I want a shawl, I have not got the money, but I wish you to trust me a week or a fortnight.” Well, brother Joseph…lets Bill have a shawl. Bill walks off with it and meets a brother, “Well, ” says he, “what do you think of brother Joseph?” “O he is a first-rate man, and I fully believe he is a Prophet. See here, he has trusted me with this shawl.” Richard says, “I think I will go down and see if he won’t trust me some.” In walks Richard. “Brother Joseph I want to trade about 20 dollars.” “Well,” says Joseph “these goods will make the people apostatize; so over they go, they are of less value than the people.” Richard gets his goods. Another comes in the same way to make a trade of 25 dollars, and so it goes. Joseph was a first-rate fellow with them all the time, provided he never would ask them to pay him.

Young suggested that the church membership would “lie awake nights” deciding means to pay debts to non-members, but they expected unlimited credit form the Saints. It appears, therefore, that Joseph Smith had more interest in distributing commodities to Mormon brethren than in running a profitable business” (Roger D. Launius, Roger Launius and F. McKiernan, F. Mark McKiernan, Joseph Smith’s Red Brick Store, page 17)

Deseret News, Thursday,December 6, 2001 (click here to be taken to the news article)

PROVO — Utah County is nearly free of the violent crime seen in most metropolitan areas.

But when it comes to white-collar crime, Utah County is king.Federal and state officials say the majority of the state’s fraud schemes originate in the politically conservative 360,000-resident region just south of Salt Lake City.

Experts say the many get-rich-quick schemes involving real estate or crafty stock market investments target members of The Church of Jesus Christ of Latter-day Saints…

It is estimated that 85 percent of residents in Utah County are members of the LDS Church.

Called “affinity fraud,” investigators say scam artists have been known to swindle the home equities and life savings out of fellow church members.

FBI agent Jim Malpede said such cases often don’t become public largely because the victims are embarrassed they were sometimes swindled by somebody who worshipped in the same Mormon congregation, which is called a “ward” in LDS culture.Such fraud — using church groups or cultural ties — costs Americans an estimated $10 million to $20 million a day, according to the FBI.

FBI agents in Utah estimate that between 60 percent and 70 percent of the financial fraud cases they investigate come out of Utah County. That includes security frauds and Ponzi, straw-buyer and illegal multilevel marketing schemes“Utah County, per capita, (has) to have the largest amount of it in the entire country,” Malpede said. He added that at any given time the FBI is investigating from $50 million to $100 million in fraud scams in Utah County.

“Some of the larger (schemes) run out of Utah County take victims from all over the country and all over the world,” he said. “One of the great things about Utah, about living here, is that you can generally trust the people. We have a very low rate of violent crime. It’s mostly, ‘Trust your neighbor, help people out when they need help.’ It’s just the nature of the area. What comes with that is a particular amount of vulnerability.”

Although Utah County developer Gary Brinton did not heavily use LDS Church connections, according to court documents he allegedly relied on close ties to persuade 30 family members and friends, including his own parents, to participate in a straw-buyer scheme.

In what has been called one of the biggest financial scandals in Utah’s history, Brinton cooperated with three First Security Bank officials to use the good credit of 30 people to secure residential loan money totalling more than $47 million, according to court documents.

Brinton’s financial problems may cost him his two most well-known businesses: Seven Peaks Water Park and Trafalga Fun Center, which are both in foreclosure, according to Brinton’s attorney, Charles Hanna. Those who tried to help Brinton may be left with their credit in ruin.

Michael Hines, director of enforcement for the Utah Securities Division, who also teaches about white-collar crime as an adjunct professor at the University of Utah, said “investors in Utah County may trust a little more than others may.”

“If you have someone in Utah County coming to their neighbors with tatoos and a bandana, asking them to participate” of course they will say no. It’s different if the person is in the same LDS ward, he said.

Hines said often the perpetrator of the fraud will ask victims to “pray” about the investment. “People need to realize that God is not a good investment adviser,” he said.

“Some of the largest successful cooperations have been through affinity, through the church,” Hines said.

Hines said it is always good business practice to research the investment to determine the risk. Upon some research, it may be determined the scheme is illegal, he said.

Last year, an Arizona man recruited three Utah County men to start a Ponzi investment scam from two companies called Cannon Capital Corp. and the Petral and Sun Co.

According to documents in Provo’s 4th District Court, the group used their membership in the LDS Church to recruit victims in an illegal securities debenture.

Victims were promised a 50 percent-per-quarter return on their investments in a complex bank securities plan.Investigators say original investors were being paid returns with money acquired from new “investors.” Representatives told victims it was a “sure deal,” court records say.

One Provo representative, Robert Morgan, told victims “the Lord had come to him and told him of this investment and the investment worked,” according to court documents.

Morgan was charged in June with multiple felony counts of securities fraud, selling unregistered securities and being an unlicensed securities agent.

He is awaiting trial in 4th District Court.The head of the scheme, Randall Watson Law, Mesa, Ariz., pleaded guilty in 4th District Court on Nov. 16 to 34 felony counts of securities fraud. He has not been sentenced.

Deputy Utah County Attorney David Wayment said his office has identified 11 victims, many of whom had invested life savings, totaling a loss of $5.8 million.

Charlene Barlow says a good number of fraud cases also are found in Salt Lake and Davis counties. However, Barlow, who works in the financial-crimes unit of the Utah Attorney General’s Office, does notice the number of cases involving church-based relationships.“It’s sad that people will abuse their church relationship to do that,” Barlow said. “We tend to trust the people we know, and we tend to trust the people we see every Sunday.”

In the past, the LDS Church has warned its members against questionable investments.

At the April 2001 LDS General Conference, Elder M. Russell Ballard of the Quorum of the Twelve warned about members driving themselves into debt and seeking risky investments to make up for it.

“There are no shortcuts to financial security. There are no get-rich-quick schemes that work. Perhaps none need the principle of balance in their lives more than those who are driven toward accumulating ‘things’ in this world,” Elder Ballard said. “Do not trust your money to others without a thorough evaluation of any proposed investment. Our people have lost far too much money by trusting their assets to others.”

Church spokesman Cole Newell said the church published a booklet in 1992 called, “One for the Money” as a guide to steer members clear of “high-risk investments” and toward smart money management.

Hines said many people do not know how damaging white-collar crime can be.

“You can certainly rob somebody with a gun,” Hines said. “But this is the only crime where you can actually steal the equity out of someone’s home or their life savings.”

Many investigators say victims of white-collar crime often experience a high rate of divorce and some attempt suicide.

Hines said the biggest defense against becoming a victim is education. The FBI, in cooperation with the Utah Department of Commerce, is distributing a list of “key phrases” often used in financial scams.

“This is not someone stealing your car overnight; this is what you’ve worked for all your life,” Hines said. “And the weapon being used is trust.”

The Economist Jan 28th, 2012 (click here to read entire article)

The hook of Mormon

The state thought to have the most affinity fraud per head is Utah, where 60% of the population are Mormons. In 2010, regulators and the FBI were investigating cases there with 4,400 victims and perhaps $1.4 billion (or $500 for every Utahn) in losses. The numbers have surely climbed since, with the three largest cases alone involving combined losses of up to $700m, says one investigator.

Mormons tend to be both trusting and welcoming of newcomers, says Keith Woodwell, head of Utah’s Division of Securities. As soon as you pull up to your new house, neighbours appear to help you unpack. A scammer who gets his foot in the door can exploit this closeness.

LuElla Day, for example, lost $1.2m in a deal hatched by Daniel Merriman, a fellow Mormon she had known for four years. “He’d spoken at our meetings. When I sold my farm, he came and said the bishop had asked him to help me invest the proceeds,” says the 81-year-old. He told her the money would go into government debt. The transaction was done on a handshake. Ms Day never got a penny back

Credulousness is not confined to sweet old ladies. One of Ephren Taylor’s victims was an electrical engineer with an MBA. A man in Utah was taken for $50,000 by his next-door neighbour, who offered a chance to invest in a new type of ice machine. Nothing remarkable there, except that the victim was a retired federal agent who had worked on white-collar fraud cases.

Why do such people let their guard down? “Everyone is looking for a shorthand way to judge character, and affinity settings offer that, at least in theory,” says Jeff Robinson, head of the Utah County Attorney’s investigations bureau. Tribal ties foster trust, which is usually a good thing. But it can be abused.

Members of The Church of Jesus Christ of Latter-day Saints have long been counseled to manage their finances wisely. The Church created a pamphlet called All Is Safely Gathered In to provide suggestions to Church members in managing their finances. Additionally, on 27 February 2008 the First Presidency of the Church counseled Mormons to be wise in their investments in a letter that was read to Mormon congregations:

Dear Brothers and Sisters:

Reports of fraud schemes and unwise investments prompt us to again counsel members with respect to prudence in managing one’s financial affairs.

We are concerned that some Church members ignore the oft-repeated direction to prepare and live within a budget, avoid consumer debt, and to save against a time of need. Consideration should also be given to investing wisely with responsible and established financial institutions. We are also concerned that there are those who use relationships of trust to promote risky or even fraudulent investment and business schemes.

While all investments carry an element of risk, that risk can be managed by following sound and proven financial principles: first, avoid unnecessary debt, especially consumer debt; second, before investing, seek advice from a qualified and licensed financial advisor; and third, be wise.

We encourage leaders to regularly teach and reemphasize these principles.

Sincerely yours,

Thomas S. Monson

Henry B. Eyring

Dieter F. Uchtdorf

source: themormonnewsroom.org

For decades, Church leaders have also counseled Church members to be wary of investment schemes that may be fraudulent. The following are excerpts from some of the addresses by Church leaders that have touched upon that topic in the past:

Elder Dallin H. Oaks, “‘Brother’s Keeper’”

“The white-collar cousin of stealing is fraud, which gets its gain by lying about an essential fact in a transaction. Scheming promoters with glib tongues and ingratiating manners deceive their neighbors into investments the promoters know to be more speculative than they dare reveal. Difficulties of proof make fraud a hard crime to enforce. But the inadequacies of the laws of man provide no license for transgression under the laws of God. Though their method of thievery may be immune from correction in this life, sophisticated thieves in white shirts and ties will ultimately be seen and punished for what they are. He who presides over that Eternal Tribunal knows our secret acts, and he is ‘a discerner of the thoughts and intents of the heart.’”

Elder Joseph B. Wirthlin: “Earthly Debts, Heavenly Debts”

“From time to time, we hear stories of greed and selfishness that strike us with great sorrow. We hear of fraud, defaulting on loan commitments, financial deceptions, and bankruptcies. We hear of fathers who financially neglect their own families. We say to men and women everywhere, if you bring children into the world, it is your solemn obligation to do all within your power to provide for them. No man is fit to be called a man who gathers around himself cars, boats, and other possessions while neglecting the sacred financial obligations he has to his own wife and children. We are a people of integrity. We believe in honoring our debts and being honest in our dealings with our fellow men.”

Elder Joseph B. Wirthlin: “Personal Integrity”

“Having received the Spirit of Christ to know good from evil, we should always choose the good. We need not be misled, even though fraud, deception, deceit, and duplicity often seem to be acceptable in our world. Lying, stealing, and cheating are commonplace. Integrity, a firm adherence to the highest moral and ethical standards, is essential to the life of a true Latter-day Saint.”

President Lorenzo Snow, pg. 21, second Paragraph:

“The Latter-day Saints ought to be too far along in wisdom and intelligence to fall into snares of this character. It does not pay. It will pay no man to turn his back upon these glorious principles and those things which have been received from the eternal worlds—to turn our backs upon these things and mix up and devote ourselves to the beggarly things of the world. It will not pay us. Whatever temptation may come upon us or to which we are now exposed we should listen to the history of the past and not allow ourselves to be overcome, or we will much regret it” (Deseret News, Apr. 11, 1888, 200).

President Snow page 21:

“The gospel binds together the hearts of all its adherents, it makes no difference, it knows no difference between the rich and the poor; we are all bound as one individual to perform the duties which devolve upon us. … Now let me ask the question, Who [does] possess anything, who can really and truly call any of this world’s goods his own? I do not presume to, I am merely a steward over a very little, and unto God I am held accountable for its use and disposition. The Latter-day Saints have received the law of the gospel through the revelations of God, and it is so plainly written that all can understand. And if we understood and comprehended the position we assumed in subscribing to it when we entered into its covenant through baptism for the remission of sins, we must still be conscious of the fact that that law requires us to seek firstthe kingdom of God, and that our time, talent and ability must be held subservient to its interest [see Matthew 6:33; 3 Nephi 13:33]. If this were not so, how could we expect hereafter, when this earth shall have been made the dwelling place of God and his Son, to inherit eternal lives and to live and reign with him?

Who shall say that the rich, or those that possess many talents, have any better hope or prospect to inherit these blessings than the poor, or those who have but one talent? As I understand it, the man who works in the shop, whether as tailor, carpenter, shoemaker or in any other industrial department, and who lives according to the law of the Gospel, and is honest and faithful in his calling, that man is just as eligible to the receiving of these and all the blessings of the New and Everlasting Covenant as any other man; through his faithfulness he shall possess thrones, principalities and powers, his children becoming as numerous as the stars in the firmament or the sands on the sea shore. Who, I ask, has any greater prospect than this?” (Deseret News: Semi-Weekly, Jan. 23, 1877, 1).

And how was this received? I’m dying to know.

Very well Brother Timothy…very well

lol

I am sure this was an awesome lesson. Good work, Bro. Barker.

For the record, our wards RS went well on this. I was a bit nervous at first, but the comments in class moved the lesson to a broader model of following the first two great commandments of loving and serving others as we would like to be served.